As we are now in the tax season you really have to take a close look at your tax obligations and what is required of you. If you are involved in foreign investments then you need to be particularly diligent about reporting using the Form 1135, as the CRA will no doubt be closely scrutinizing this sector of the tax reporting.

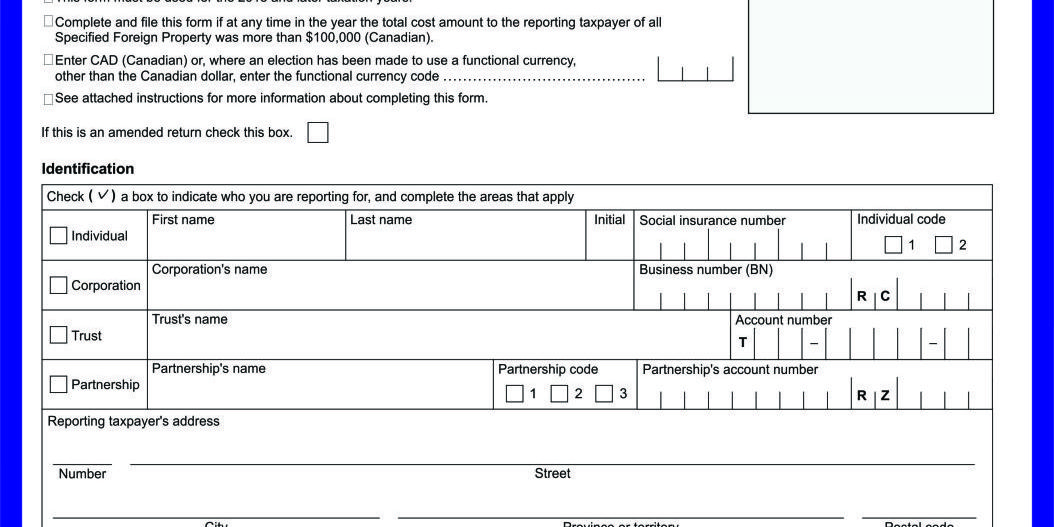

There are exemptions to having to file the T1135, but unless you totally understand your tax obligations regarding this you would be better to consult with a Toronto tax accountant to see if you really do qualify for exemption. A recent post we did on this Foreign Income Verification Statement will also give you some basic understanding.

You may be thinking that the concept that the CRA is going to watch the foreign income much closer is a little bit of a scare tactic. What with tax season being so busy for this government department it is unlikely they will have the resources to do this. You may want to think this through again. There has always been a penalty in place for not filing the T1135, but the tax department was somewhat lax in its collection. Now they have automated their system to computer generate a letter issuing an assessment for the maximum penalty owed for late filing.

One mistake a lot of people make when E-filing is not realizing that they must still submit the T1135 if it is applicable to them. In the past the excuse that you didn’t realize this might have worked, but don’t count on it for the future.

Another big step as we have talked about is the new T1135 which according to many tax experts is a potential nightmare designed to create all kinds of additional nightmares.

In the past you may not have given your foreign investments much thought especially if you are an individual and not a big Corporation. Even if you were holding slightly over the $100,000 threshold for filing the verification statement you may have thought it was no big deal. If this is the case but this year you realize the seriousness of not filing and are planning on doing so, then you may also want to consider voluntary disclosure for the years that you did not file, but technically by law were required to. The CRA is not going to be forgiving of blatantly not filing the T1135 just because you were over the threshold by $5-$10,000.

If you have any foreign investments and are not clear as to how they are going to affect your tax implications then contact us here, and let us complete your personal tax return for you, and if necessary your business tax return as well.