If for whatever reason you are not familiar with the concept of tax instalments, don’t worry, many people aren’t. If you work a regular job for a specific company, your tax deductions will be automatic throughout the year, taken off your paycheque, ensuring that at the end of the financial year (April) when you file your tax return you owe the CRA little or nothing in terms of additional money. As a result, you would never experience “tax instalments”, which are generally saved for the self employed, people with investment income, small or large businesses, farmers, etc.

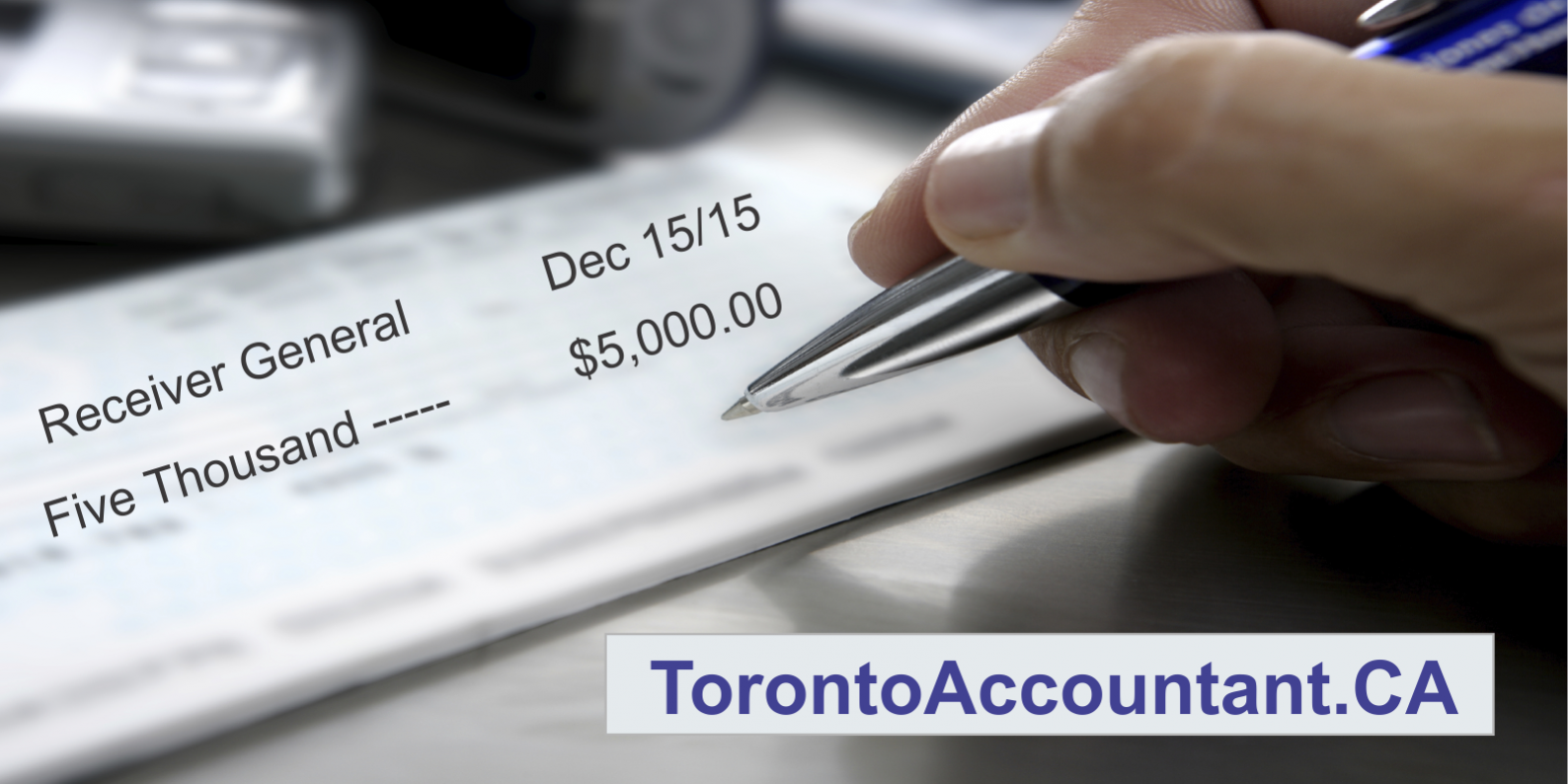

So, what are tax instalments? Essentially, if you break it right down, it is simply to avoid having to owe the CRA a mass lump sum at the end of the year. It cuts up the estimated amount you will owe in taxes in April of the next year, so that you don’t have to pay in a lump sum. Usually it will be cut up quarterly, so if you owe, say $20,000 in taxes one year, you will likely be paying $5000 quarterly…though not many people will end up owing THAT much in taxes. Really, in the end this should be helpful for a small business owner, as it allows them to better manage their spending over the course of the year and not suddenly be caught off guard by a massive payment at the end of the year that they are completely unprepared for.

Who has to pay on these instalment plans? Well, generally the rule of thumb seems to be if you owe over $3000 on your tax return at the end of the year (there are a large number of exceptions, check out the CRA website for more details), your taxes for the next year will be broken up into quarterly instalments. Of course this brings immediately to mind: “How can they possibly know how much I’ll owe at the end of NEXT year?” Well, of course they don’t, they are just making an educated guess that you will likely be paying something similar. So what happens if they are wrong? Well, logically it depends what direction they are wrong in. If you owe more at the end of the year, let’s say owing $25,000 rather than the $20,000 hypothesized above, you will owe an additional $5,000 at tax time. If you have a bad second year, well you’ll get a refund on any over payment.

Making instalment payments is not optional, and failing to pay can result in interest payments. However, if you are not expecting to owe nearly as much money, you can ignore the demands for cash, and rely on your tax bill arriving at $0 at the end of April, in which case the interest fees will be waived. Generally speaking, if you paid income taxes last year, you will be asked to make instalment payments THIS year. Don’t panic, figure out whether paying up makes sense (it usually does), make an informed decision. In the end, instalments, at the very least, can make April a slightly less horrifying time of the year…at least you aren’t paying everything all at once! Your accountant should be able to assist you with determining if tax instalments apply to you.