Congratulations on starting a new small business

Like the Tax Story I am about to tell you below using the infographic, you have decided to start a new small business. There are a number of decisions you have to make when you start a new business. Should you incorporate or do you operate as a sole proprietor or partnership? What accounting software do you use and ultimately do you have to, or wish to register for a GST/HST account with Canada Revenue Agency.

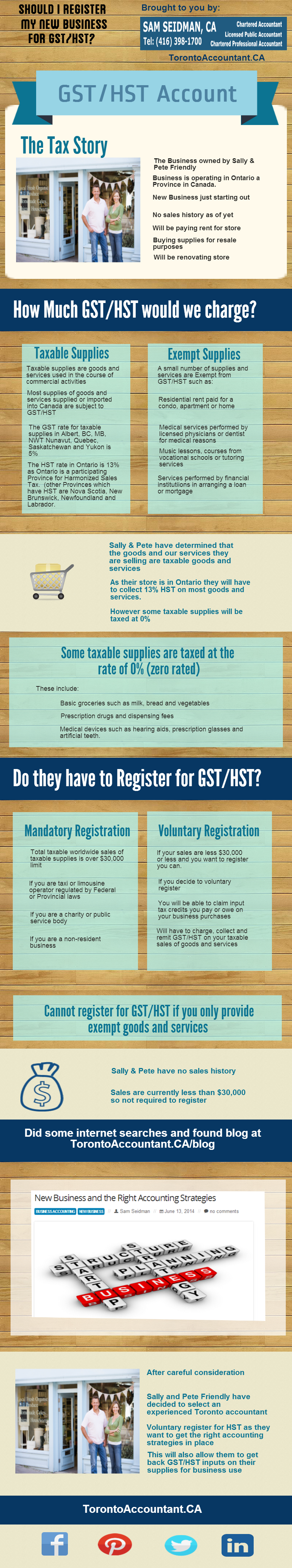

The tax story below is about Sally and Pete Friendly. The Friendly’s are operating a new retail business in Ontario, Canada. They are trying to decide on whether to register for GST/HST or not.

The story is illustrated in the Infographic – Should I register my New Business for GST/HST?

Sally and Pete have decided to voluntary register for GST / HST even though they do not have any sales as of yet. They know that they will have sales in the future and will have to register within a few months. Voluntary Registering now will allow them to get their accounting system in place to track GST/HST and to claim input tax credits on goods purchased for resale, rent and store renovations.

If you need to Voluntary register you will need to obtain a Business Number and fill out Parts A, B and F of the Request for Business Number form RC1. This can be done by internet, telephone mail or by fax or if you already have a business number than all you need to do is complete RC1A form.

The Friendly’s have also decided together with their accountant that it is advantageous not to use the Quick Method to account for the GST/HST. Its always best to consult an experienced accountant to decide what is best to do in your circumstances.