You may not realize it but the CRA makes your privacy a priority. It has very stringent rules as to who it will share information with concerning your tax matters. This is a good thing because nobody wants to have their financial information shared. Perhaps the exception to this rule is when there have been tax court proceedings that have taken place, in which case a great deal of information then becomes public.

In many cases tax payers use additional help in preparing their taxes. Sometimes they ask friends or family members to do their taxes for them. It could be they don’t feel comfortable doing their own taxes or don’t have the time for it. There is nothing wrong with this however, if you are doing this and then have to discuss your tax filing matters with the CRA, it could cause some problems for you.

The CRA may have some questions concerning your tax filing that you are not sure how to answer because you did not complete them. Do keep in mind that you are ultimately responsible for your tax matters, so you really should know everything about what your tax return contains, and have a good understanding of this. You can give authority to the CRA to discuss your tax matters with an individual or firm that you choose and the most likely person for this would be the individual who filed your return.

You will need to give this authority in a formal fashion, which there are a few options. If you are comfortable with the online tax system that the CRA has set up and you are accessing your tax account electronically, there is an option there to authorize your representative. The authorized individual will then be able to deal with the CRA on your behalf in the same online manner.

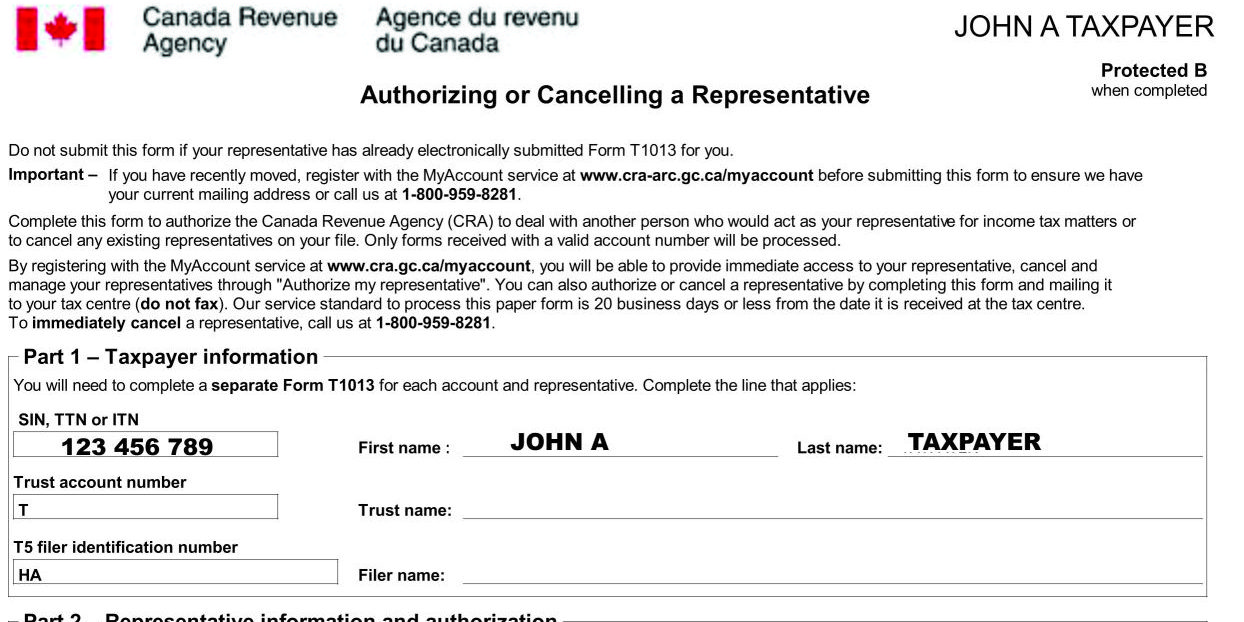

Another option is to give authority by mail, by filling out a form T1013. This form works for both authorization and removing authorization. Which is something you should do, if you are switching tax authorities from one person to another.

You should also consider giving your Toronto tax accountant the proper authority to deal with the CRA on your behalf if necessary. This saves a lot of time and hassles for everyone concerned in your tax matters. You also want to keep in mind to choose the individuals that you are giving this authority to carefully. Make sure that you know your tax preparer is a professional and established tax preparer as this is sensitive information that you are giving access to.