It can be really difficult when you are operating a small business to keep its dealings separate from your personal life. There are so many different aspects of a small Company that demand attention and more often than not there is only one person taking on all of the responsibilities, which is you.

When it comes to the administrative and financial obligations it seems these always get pushed way down on the to do list with the hopes that you can get around to them after working hours, but this never seems to happen.

It is important for your year end tax situation to have your business records in proper order so your taxes can be completed properly. Not only is this the criteria that the CRA demands but it also beneficial for your tax situation in regards to potential tax savings.

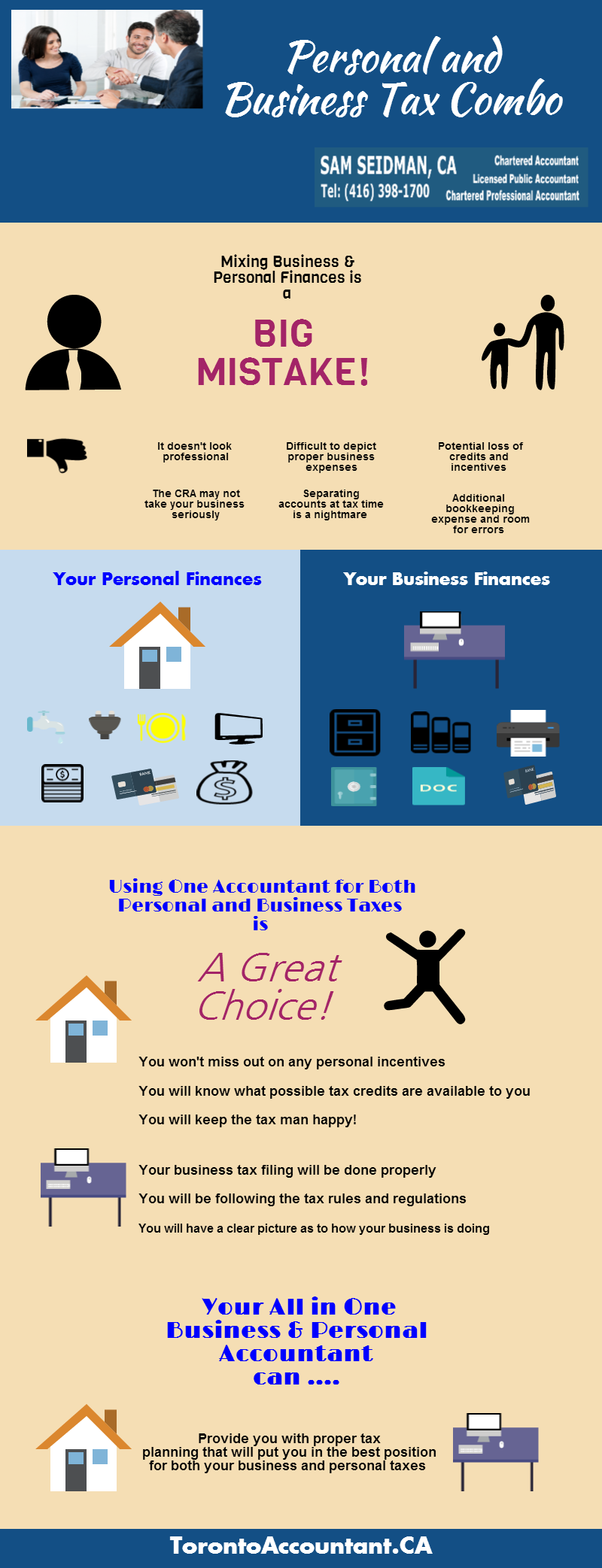

As shown in the infographic in a condensed way why keeping your personal and business finances separate is important, it also points out that there are a lot of advantages of having one accountant do both your personal and business taxes for you.

Be sure to give Sam Seidman a call here at TorontoAccountant.CA, at 416-398-1700, as he is well versed in both of these tax matters and will ensure that your filings are done properly and effectively.