For the average tax payer when they hear about some industry losing some of their tax benefits they really have no interest. Basically they feel that if the average tax payer has to be hit hard with taxes then so should business.

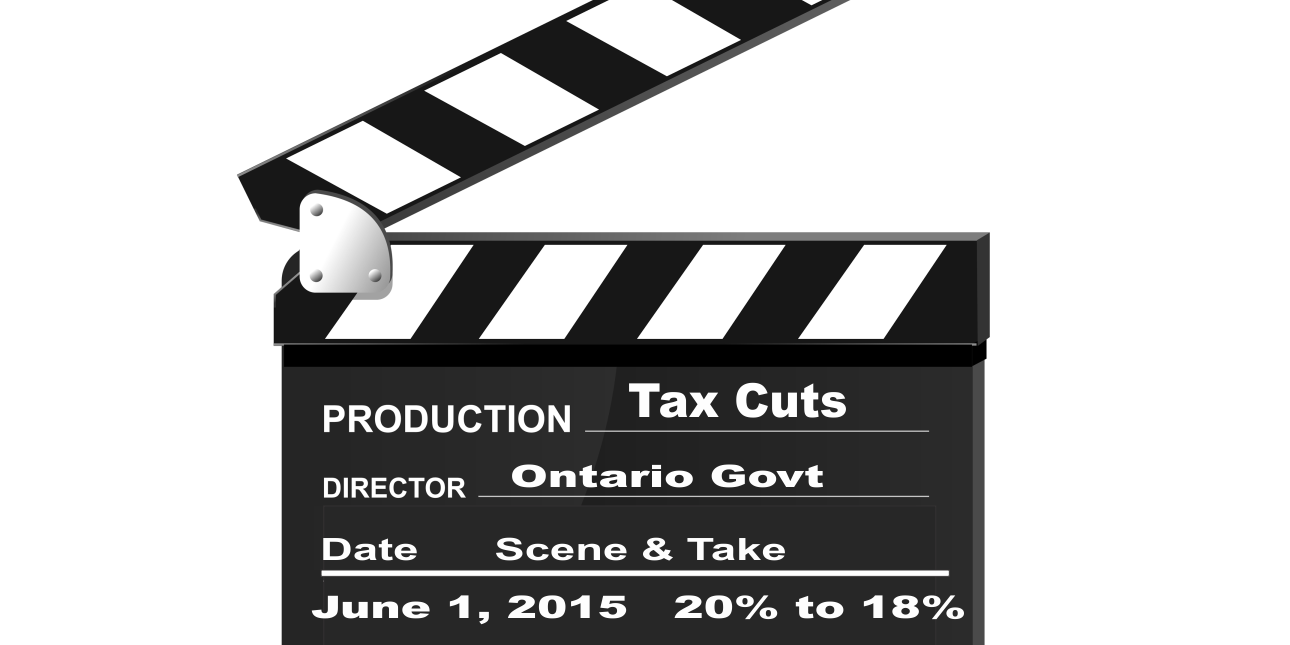

The most recent hit was to the film industry, as the Ontario Government reduced tax credits in three sectors of the industry. The Ontario Production Services Tax Credit (OPSTC) was reduced to 21.5%. Ontario Computer Animation and Special Effects Tax Credit (OCASE) was reduced to 18%.

We as the general public should realize that this industry has brought in a ton of money to the province and has provided thousands of jobs. Although the tax credits were only reduced and not totally cut it still has a significant impact on the industry. Many film makers made their productions here because of the stability of the tax system.

One of the biggest concerns is that these new cuts were going to have a dramatic and costly effect on productions still in the workings. It seems as though the government is contemplating putting the cuts on hold for those films that are already started. Budgets have to be set for these productions and a tax cut such as this would have a major impact on this.

It is mind boggling to try and determine why the government decided to go after the film industry with these proposed cuts to the tax credits. Here we have an industry that indicates they have a proven track record for bringing money into the province and providing jobs even if they are part time. Why not go after other industries who are getting substantial tax breaks but as yet have not proved themselves.

On the other hand most of these claims of how much benefit is being received by the Province is from the industry itself. Some of the other provinces have taken steps to cut some of their tax credits for the film industry.

There were government inspired studies done several years back as to the gain for the province from this industry and it wasn’t all that impressive, however no steps were taken at that time to cut the tax credits. The premise is that the jobs that are created are only temporary with no long term results.

There is no doubt that the Ontario government wants to take whatever steps it can to clear the deficit of the province. It is on the hunt for finding ways to do this that are not going to take a direct hit at the tax payer.

In the past most tax payers shut their minds as to what is going on with the government concerning tax issues as long as it didn’t directly involve them. Times are changing and many of the general public are becoming more interested in what can affect them indirectly, and what the long term impact of government decisions can have on them.