If you have received some type of correspondence from the CRA and haven’t a clue of what it is saying, don’t think that it’s just you who is experiencing this because there are tons of tax payers in the same boat. In fact, quite often when a follow up is made to try and decipher the contents of the tax notice it still doesn’t become any clearer.

Many tax payers have constantly complained over the years that even the tax information given to the public in general soon becomes complex and extremely difficult to understand. In fairness though we should say that recently there has been a lot more effort by the CRA to clarify their data so it is more understandable by the layperson.

Anyone that is involved with the CRA directly or indirectly will probably tell you that their job is becoming increasingly difficult as each year goes by. Accountants for example, are constantly having to decipher new laws and regulations so they can best serve their clients, and this is not an easy task, and basically the Canada tax laws are based on interpretation.

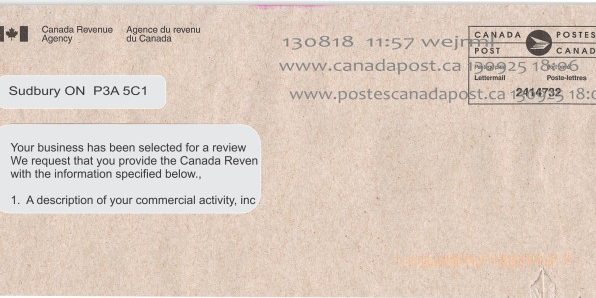

The main complaints concerning much of the communication that is sent out to Canadian taxpayers consists of it not being properly organized, it is often confusing and it lacks professionalism. It can also be overly severe and vague.

Correspondence sent out by the CRA costs money. Somebody has to prepare it, write it and mail it and even if it is electronically done there is a cost to this as well. The costs however, for material that meets the complaints noted above are even greater, because the recipient now has to call the CRA for clarification and this takes manpower to answer.

If one wanted to be generous we could offer an excuse for this type of material by saying that the CRA is simply over worked and lacks the proper manpower. Then to counter this we would have to ask then why have there been so many cutbacks that seems to involve key personnel?

What is really ironic however is when the politicians who want to make an impact on the taxpayer is able to disseminate material that clearly outlines the goals set and a great deal of effort is put forth into making sure the material is properly executed and understood. It would seem that in summary the communication concerning the CRA is a double edged sword.