Canada is a great country to live in we have 10 Provinces and 3 Territories. However as a Canadian resident there are many taxes which you will pay and the rate and amounts will depend on which Province in Canada you live in as well as how good your tax planning is to ensure that you are getting all of your entitled tax credits and deductions.

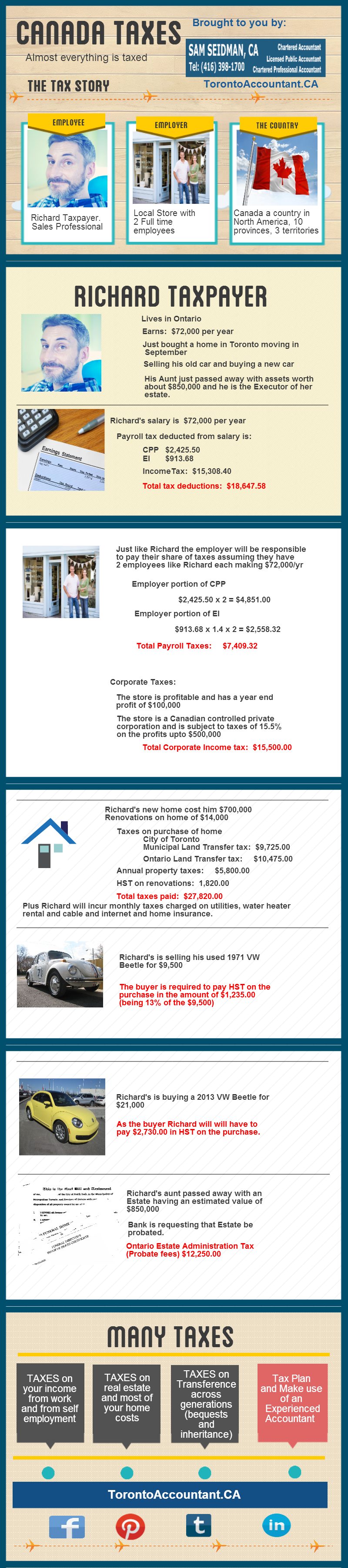

I have created a “Tax Story” about Richard Taxpayer who lives in Ontario. I have developed this Infographic to tell you the story about Richard.

As can be seen in the above Infographic Richard has to pay a lot of taxes in the year ranging from payroll taxes of $18,647.58, land transfer tax on his home Toronto home purchase of $20,200, of which part of this may be refundable as a first time home buyer, and ongoing taxes on utilities as well as HST on the purchases he makes during the year.

As well Richard being the Executor of the estate of his aunt Richard has to pay Probate taxes of $12,250 in order to probate her will.

Of course Richard must also file a terminal tax return for his deceased aunt and pay any taxes owing up to date of death and he may also have to continue to file Trust tax returns for the estate depending on the instructions in the will.

Also Richard or the beneficiary may receive a Canada Pension death benefit which also is taxable.

It is best that Richard and other similar taxpayers use the assistance of an experienced tax accountant as the Canada tax system is complex.