Basically the Canada tax system is one that is based on a honour system or as they call it a self-assessment system. This means that that you are compelled to file your taxes every year but it is based on your income and all the deductions that you can claim as is all done via your tax return and hopefully through a qualified accountant that can help to ensure that you are getting all the tax credits that you may be eligible for.

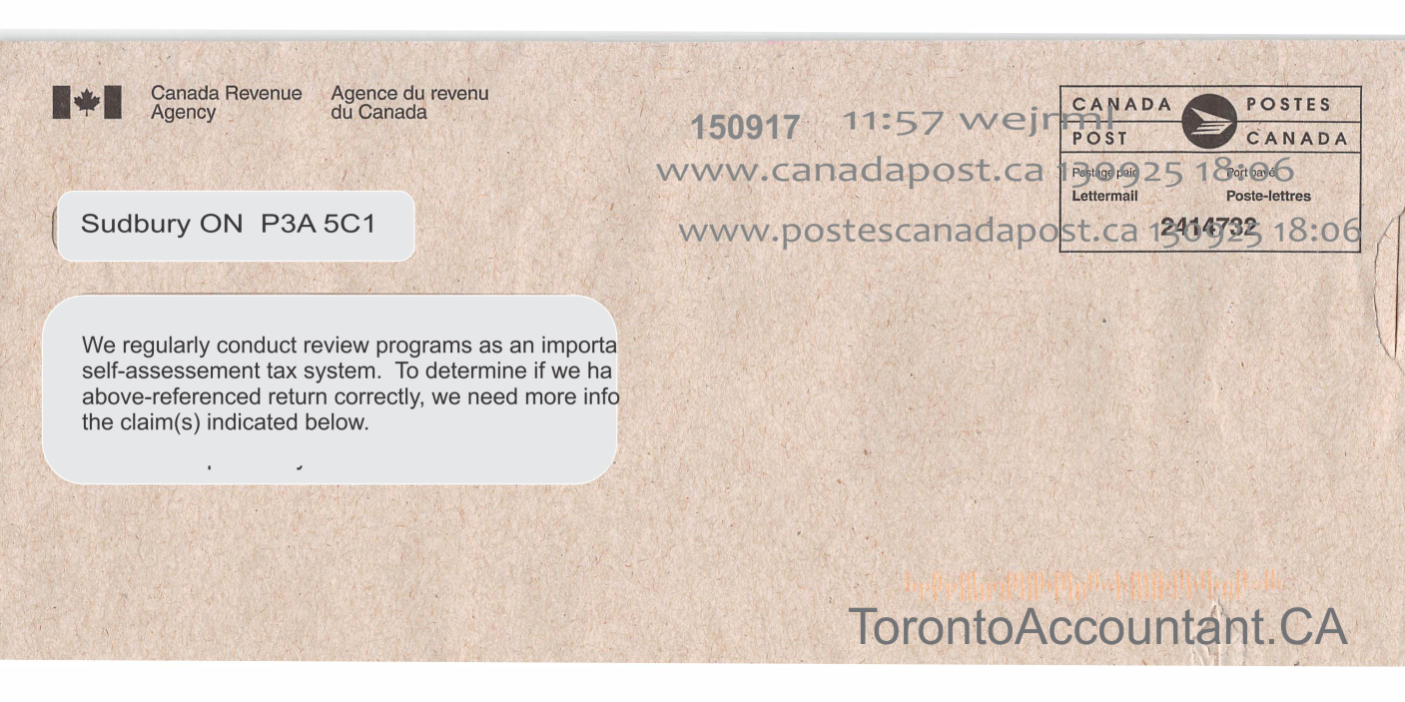

In most cases your taxes are filed according to the due date and then a few weeks later you will receive a notice of assessment. For many this seems to be the closure for the year in regards to their tax filing obligations. On occasion some taxpayers will receive a notice of review and this is commonly followed after the summer months. This is because it has become a general practice that during the summer months the CRA will do some random reviews of tax returns and choose a collection of these to follow through with further. They may do this by asking for additional information. One of the reasons they do this is basically to keep us honest as Canadian citizens. One thing they are very clear to point out is that a tax review is not a tax audit.

According to the CRA they have a set format that they follow for review selections. They are saying that it may be just a random selection or that they done a comparison or want to do a comparison of information that they have received from third-party sources an example of this would be your T4 slips. Then there may be other concerns that have drawn them to do a review such as your credits or deductions. You may have already received your notice of assessment and are quite shocked to find it now that you are under a review several weeks later. This is because a full review or a manual review is not done as a rule during the initial process of the notice of assessments. The CRA does use computers for screening and reviewing returns so the computer could flag you potentially for a review at a later date. It is highly important that you keep all of your supporting documentation that you used for your tax return even that which you did not have to submit such as your medical receipts, for example.

Do be aware that you cannot refuse to go through the review process or ignore a request for further information. However there are rules that have to be followed by the CRA concerning these as well as you. Once you have received a request for information you usually have 30 days to provide what it is they are asking for. If you neglect to do this then the CRA can do a reassessment of your return and deduct any credits that you may have claimed that you are not providing the information that they are asking for. If you happened to miss the deadline for sending the information and you can file a T-1 adjustment form this will allow you to reclaim the credit. However, this is just an extra hassle for you so best replied first time around.