Once you have filled out your income taxes for the year, and you hit that bottom line where you happen to be one of the unfortunate ones that have to pay, how do you go about it? The CRA of course expects you to make the immediate payment by sending the money along with your tax return. You on the other hand may be thinking that perhaps you have not done your taxes correctly, and just maybe you don’t owe anything. Or, you may just not have the money to make the payment at the moment.

One thing to keep in mind is that if you do owe money for taxes and do not make your payment, then the interest clock will start ticking. If you filed on time at least you will not be hit with late fees or penalties for late filing.

So once you realize that there is no getting away from it and you do owe Canada taxes, then best you get your payment made as quickly as possible. Being as the CRA wants you money as owed, they have implemented several ways for you to make that payment.

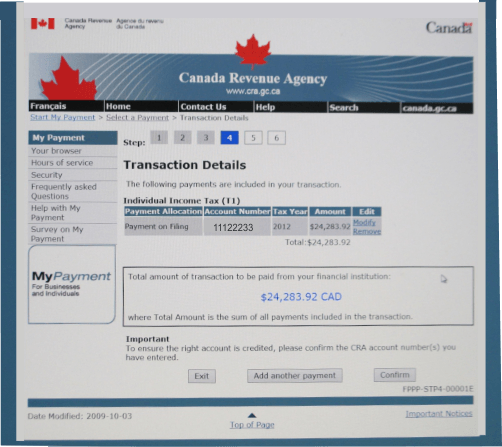

You can make your payment to the tax department just like you pay any of your other bills online. If you check the list of payees of your financial institution that you use for your telebanking or online banking, you will most likely see that the CRA or Receiver General is amongst them. You can simply add them to your list of creditors that you make payment to or you can use CRA my payment

If you don’t use online banking then you still have some options open to you. You could even be able to make your payment through your credit card. There is at least one Company that will allow you to make your payment via your credit card to them, and they in return will forward it to the CRA. Some people like this rather unique method because it allows them to build points on their credit cards like air miles, for example. This is fine if you are going to pay the amount off at the end of the month, but if not then you have just increased the amount owed on the credit card balance and are going to end up with interest being paid on this. Most people simply do not like owing the CRA money, as they are somewhat nervous of this governing body.

There is of course the old fashioned way to pay your Canada taxes, which is by sending a check through the mail.

What it comes down to is first making sure that your taxes are done right. You can be assured of this if you use a good chartered accountant or for Torontonians there is also the choice of a Toronto tax accountant. Then if you owe money get it paid the best way possible.